The Problem

Put simply: it’s 2012, and there’s still no fast, easy way to transfer money digitally.

While credit and debit cards are an easy way for consumers to pay for things, they present a lot of problems. For one, consumers can only use them to pay merchants for purchases; there’s no way to use your debit card to pay a friend back for lunch. Additionally, the card is often the only way for consumers to transfer money; a consumer who loses their wallet on vacation, for example, could be left helpless while they wait for their bank to ship them a new card.

Many merchants, too, have a love-hate relationship with credit cards. While accepting credit cards can increase a merchant’s sales, it comes at a cost: in 2011, 44 cents of the average transaction was paid to credit card processors in the form of “swipe fees.” Additionally, fraud is a huge issue; according to the Aite Group, credit card fraud costs the U.S. card payments system $8.6 billion per year; to maintain a profit while dealing with those costs, not only do credit card companies charge merchants this percentage fee per transaction, but they often hold businesses accountable to pay back fraudulent credit card payments made to them.

Businesses - especially in the wake of the deepest recession in generations - must pass along these costs, resulting in higher prices for all consumers.

Consumers use smartphones for more and more these days. There are apps for almost everything: turn-by-turn navigation, calendar and to-do list management, communication, and much more. Wouldn’t it be great if we could use our smartphones to pay both merchants and our peers?

Our Solution

Hermes Commerce Inc. (HCI) is a National Science Foundation-funded startup focused on developing a mobile payment system that facilitates peer-to-peer payments and consumer-merchant transactions. Dr. Joshua Cross, the founder and Chief Technical Officer of HCI, is a Cornell-educated physicist and serial entrepreneur; Dr. Cross and two other HCI employees have thus far spearheaded the company’s development efforts.

In contrast to the current card payment system, HCI aims to provide a first and foremost secure transaction system to drastically reduce fraud and eliminate these point-of-sale charges; in short, to make the digital transfer of money quick, easy and reliable.

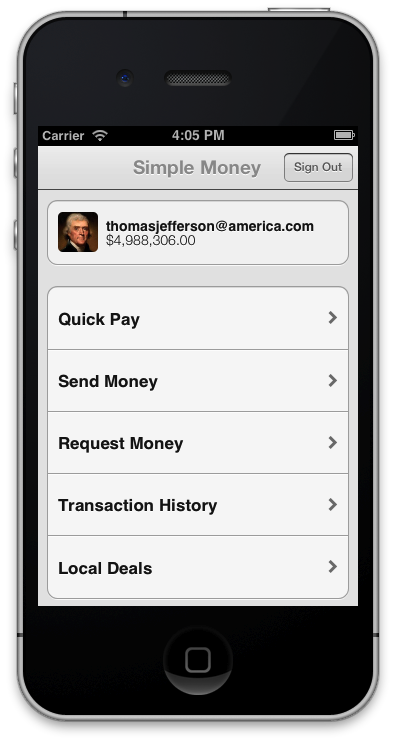

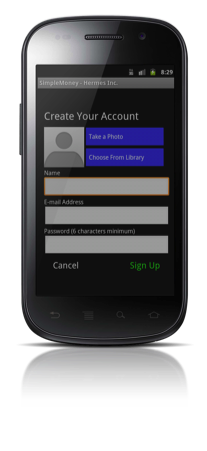

Our goal: build "SimpleMoney," the consumer iPhone and Android app for HCI

Momentum - or lack thereof - is the enemy of anyone looking to change how business is done, and it’s certainly a concern for HCI. Merchants won’t derive any value from adopting a new payments system if nobody uses it, and so HCI seeks to drive consumer adoption of its platform by providing a powerful, intuitive user experience through mobile apps for the iPhone and Android platforms. Our goal was to build those mobile apps.

Additionally, by including value-added services in our application — local coupons, recommendations and customer-relations management — our application will drive adoption among consumers and merchants.

Requirements

We elicited our initial requirements over the course of two meetings with our project sponsor. After drafting these, we presented them for our peers and the department faculty. We received a lot of great feedback from both presentations, and expanded our original requirements scope to better encapsulate what a truly competitive mobile app would look like, including features like QR payments to merchants and recommendations to related merchants using the service.

With SimpleMoney, we made payment easy:

- Blazing fast payments. Scan a QR code to pay instantly and securely with your phone.

- Send money to anyone. Anyone with an email address can send or receive a payment.

- Keep track of your finances in real-time Instant payment notifications sent to your phone and email.

- Find the best deals around you. Save money at nearby businesses with SimpleMoney coupons and recommended retailers.

Design

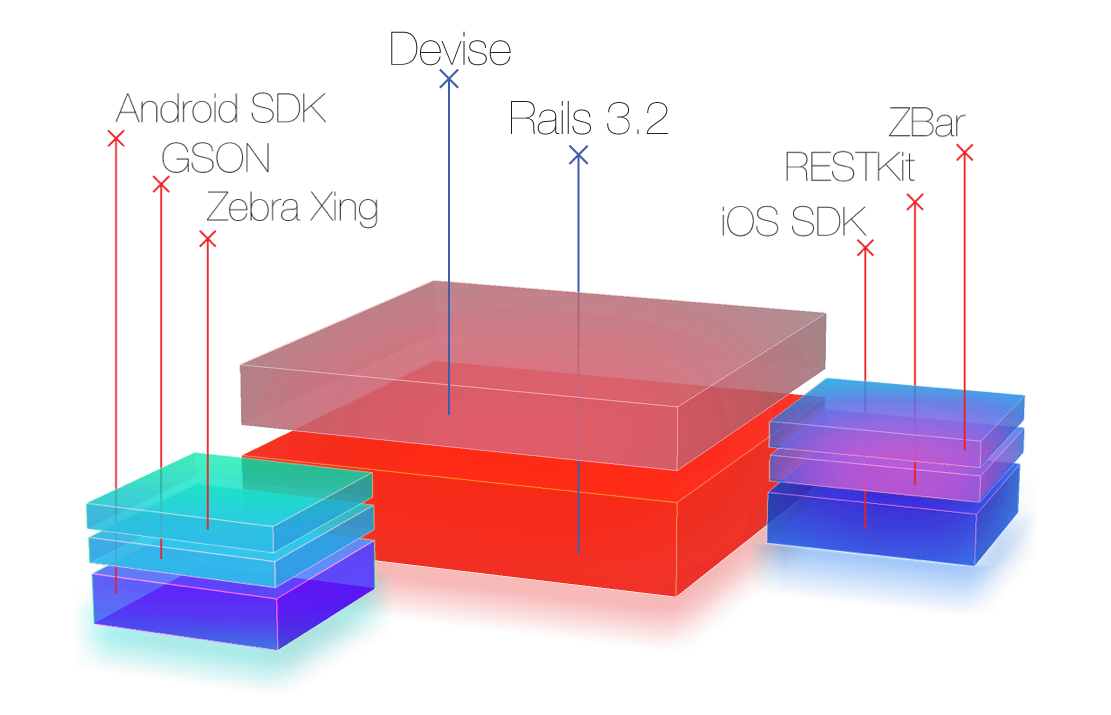

We built SimpleMoney with proven, enterprise-class technologies to provide a rich and secure experience to consumers. Our backend was built with Ruby on Rails a web application framework designed for rapid prototyping and development, and our mobile apps include open-source libraries GSON and RestKit for data-mapping, and ZXing and ZBar for QR decoding.

Integrating these real-world-tested libraries allowed us to use our limited time to focus on what we thought was truly important: creating a fast, easy-to-use and innovative payments experience.

View our Design Document (PDF)